Home > Blog > Apartment Living is the New Australian Dream

When it comes to finding a place to live, there are a few different options to choose from. In Sydney, two of the most popular choices are apartments and houses. Both have their own distinct advantages and disadvantages. But what’s the difference between the two? And which one is right for you?

Choosing between an apartment and a house can be difficult. There are a lot of factors to consider, and it can be tough to know what the best option for you is. Fortunately, there are reliable experts like Inhaus Living that can assist you. Our designers will discuss every detail with you, making accommodations to suit your lifestyle.

So, if you are wondering what the best option for you is, read on. We’ll go over the key differences between apartments and houses. We’ll also give you some things to talk about that will help you make the right decision for your specific needs.

Jump to:

What is the Difference Between an Apartment and a House

Why Do First Time Buyers Prefer Apartments Over Houses

What Are the PROS and CONS Of Buying an Apartment or a House

How to Buy an Apartment or a House

Inhaus Living for Stunning Apartment Interior Extension/Addition/Renovation

What is the Difference Between an Apartment and a House

When you’re looking for a new place to live, it can be hard to tell the difference between an apartment and a house. Is one better than the other? Are they both the same? Well, we’re here to help! Here are some key differences that will help you decide whether an apartment or house is right for you:

Apartment

Apartments are usually part of a larger complex that contains multiple units. They are typically smaller than houses and have less square footage. If you’re looking for convenience, then an apartment might be right for you. You’ll be able to get to work quickly and easily, and there will likely be plenty of other amenities nearby (like restaurants, shopping centres and movie theatres). One of the main advantages of living in an apartment is that they require less maintenance and upkeep. However, they have less privacy than houses.

Houses

Houses are a much more traditional form of living and generally larger than an apartment, with more rooms and more space between them. They are free-standing structures that come in a variety of sizes. They usually have more square footage than apartments and often come with yard space. They also offer more privacy than apartments because they have individual entrances off a shared driveway or street.

Why Do First Time Buyers Prefer Apartments Over Houses

Sydney is one of Australia’s most expensive cities, and it’s not hard to see why. It has a high population density and high cost of living, making it difficult for people who want to live on their own to find affordable housing options. That is why the current market for first-home buyers in Sydney is dominated by apartments. In fact, it is common to find that this group of buyers prefers to purchase an apartment before moving on to a house. The reason? They are more affordable and easier to maintain.

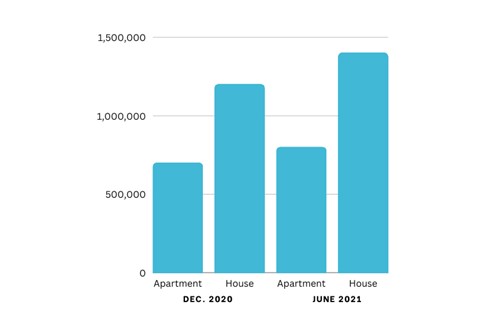

Graph showing the increase in price of housing in Sydney

First-time buyers often have limited budgets, and buying an apartment is cheaper than buying a house. New research has found that apartment prices didn’t skyrocket like houses. In Sydney, the gap between apartments and house prices has gone up by an extra 32% in the last six months alone, which adds up to more than $150,000, according to data from National Agency Upside Realty.

Moreover, amid a surge in demand for housing, the price of land in Sydney has risen by almost 40% in the past two years. So, it may be difficult to find a home with enough space for your family.

Requires less maintenance

Apartments are often much smaller than homes – which means they take up less space and require less maintenance. This means they can spend less time worrying about repairs, maintenance, and other expenses that come with owning a home.

Additionally, apartments are often located near public transportation options like trains and buses which make it easier for residents to get around town without owning a car themselves.

What Are the PROS and CONS Of Buying an Apartment or a House

The pros and cons of purchasing an apartment

While having an apartment requires less maintenance, it still has its downsides. Additionally, your neighbours are only a few walls, floors, or ceilings away from you.

PROS:

Less expensive

Although there are rare exceptions, buying an apartment is often less expensive than buying a home. According to the data presented by Domain Group, Sydney’s typical home cost $1,499,126 in September 2021. And the median cost of an apartment was only $802,475.

Less maintenance

When you buy an apartment, you don’t have to take care of the garden or the lawn. Additionally, the building’s maintenance staff will handle a variety of maintenance-related duties, giving you more free time to pursue your interests.

Low cost

While the smaller space could be a disadvantage, it also results in cheaper electricity and gas bills.

Location

Since many apartments are built close to city centres, you may live close to everything—from transportation and schools to restaurants and even your place of employment.

Extra facilities

Owning an apartment may get you access to a wide range of building amenities. There could be a tennis court, playground, gym, pool, and even a communal garden.

Security

Thieves must pass through many layers of security to get access to your apartment door, which is not the case with many houses.

CONS:

Strata/owners’ corporation by-laws

When you rent an apartment, you must abide by the rules established by the landlord, such as not letting dogs inside or hanging up clothes on the balcony. Aside from that, if you want to rebuild or make changes to your home, you need to acquire permission beforehand.

Fees

When calculating total costs, keep in mind that you’ll also have to pay a fee to the owner’s corporation to cover shared maintenance costs.

Less space & privacy

There are certain apartment buildings where the walls are so thin that your neighbour can hear every word you say. The proximity of apartment buildings means that residents are likely to know one another and that you may become the topic of rumours.

Furniture is not adaptable

The main drawback of renting furnished apartments is the lack of choice in the matter of furniture. It’s common to be told that you can’t throw away your old furniture and replace it with brand new pieces.

Rent for furnished apartments is frequently much higher

The cost of a furnished apartment is typically substantially higher than that of a regular, unfurnished one. To the tune of 50% more than unfurnished apartments, furnished units are becoming common.

The pros and cons of buying a house

There are many benefits to home ownership that first-time buyers don’t often enjoy when renting. Since buying a home is such a huge commitment, it’s understandable if you’re still on the fence about making the leap.

PROS:

Get some equity into your home

When you make your mortgage payments on time, you improve your equity in your property. Building equity in your house when you make mortgage payments can qualify you for larger loans or lines of credit down the road.

Authority over one’s own dwelling

If you own your property instead of renting, you have more freedom to make changes to it, within reason. In addition to increasing your house’s worth, many home improvements may even qualify as a tax deduction if used for medical purposes.

Raising a credit score

Paying off a mortgage is one way to improve your credit score, among the growing number of services that track rent payments made on time. While getting a home loan would likely cause a short-term drop in your credit score, it is possible to raise it again.

The Value of Your Home

Your home is likely to appreciate in value over time, making it a good investment for you rather than a landlord or management business.

Advantages on Federal Tax Returns

Despite the fact that a house purchase sometimes necessitates a sizable down payment, homeowners are often entitled to more tax benefits than those who simply pay rent. There are tax breaks available to homeowners on the state and federal levels.

Extra personal space

When you own your own house, your landlord can’t just show up at any time as they used to when you were renting.

Limitations on pets are unnecessary

If you have a pet already or are thinking about getting one, you don’t have to ask permission from anybody else to keep them inside your house. This is helpful if you have a type of pet that is typically not allowed in residential rental units.

CONS:

High initial investment required

Depending on your credit history, income, and the sort of house loan you qualify for, purchasing a home may be more expensive than renting. Closing charges and other fees may be required in addition to the down payment.

Care for routine upkeep and fixing

Maintenance and repairs, whether expected or unexpected, are the responsibility of the landlord or property management firm. When you buy a house, it becomes your responsibility to make any necessary repairs and perform any routine maintenance.

Amount Due for Taxes on Real Estate

If you own a residence in a municipality or county, you must pay property taxes to that jurisdiction. Your monthly payment will be determined by the local tax rate.

Reduced adaptability

Homebuyers who intend to remain in their new location for more than two years should consider making this significant financial commitment. If you still owe a significant portion of your mortgage after one year of ownership, selling your property could take months and cost you more money.

How to Buy an Apartment or a House

Sales of private residences are at an all-time high. Sydney and the surrounding regions have all experienced price increases because of high buyer demand and historically cheap loan rates. The key to success in this market is for you as a buyer to have a thorough understanding of the home-buying process and to have taken the necessary steps to be ready to act fast on a property that catches your eye.

Investigate the housing market

Educating oneself about the local real estate market is the first step in making a smart property investment. Knowing more about the local and national real estate market will help you make a more educated investment.

The various kinds of real estate available for purchase

You can choose from a diverse selection of possibilities thanks to Australia’s market, which features six primary property kinds.

- Single-family detached homes are in high demand because they provide privacy and space for growing families. When you buy a detached home, you also get the plot of land on which it sits. The price of this land will depend heavily on its location and market value.

- Houses that are not completely isolated from their neighbours are called semi-detached. Some mirrored pairs even have individual backyards that are an exact replica of the other. There are two names for semi-detached dwellings.

- Modern duplexes are similar to older semi-detached homes in principle. The duplex can have two titles, although a duplex only has one.

- Introduced in the 1800s, terraced homes can have anything from one to four stories and as many or as few bedrooms as their residents need. You can choose from newly built, contemporary terrace homes or more traditional designs.

- Townhouses are multi-unit dwellings often consisting of two or three stories. Each unit has its own private patio or balcony and is offered with a separate strata title.

- The term “apartment” or “unit” refers to a specific type of housing unit within a bigger complex, which may house hundreds of people. Apartments can have anywhere from one bedroom to many bedrooms, and their prices vary according to their location, floor, and the quantity of amenities they offer.

Best time to invest in a home or apartment

The solution to this is straightforward, it is at your convenience. Create your own pace, at your own time. It can be purchased at any time of year or by anyone of any age. You should only make a purchase when you are ready financially, have received financing permission from your bank, and have located a suitable home to meet your specific needs.

Make a list of everything you want in a house.

Make sure you have everything on your want list for a home written down before you go out and start looking. If a home meets all or most of the criteria on your wish list, you may want to schedule an inspection and proceed with more confidence.

Location

A property’s location is a major factor to consider. You can alter a property’s inside and exterior, but you cannot relocate it. This has an effect on the property’s worth right now and on the potential for future appreciation in the market. It’s up to you whether you want to live in the city proper, close to employment and public transportation, or in the suburbs, where you may raise a family in peace and quiet.

What aspects of location should you prioritise when deciding on a new place to call home?

Neighborhood

Is it suitable for children? Where are the closest parks or recreational centres? Does it make you feel at home? Where is the closest nightlife? Verifying the local crime rate is also recommended.

Learning Facilities

If you plan to have kids, finding a nice neighbourhood with a decent school close by is a top priority. Be aware of the public-school catchment regions and investigate the surrounding private school catchment areas as well.

Infrastructures

Access to major transportation arteries and public transit stops should be high on your list of priorities when house hunting. The availability of water and the ability to connect to the internet are also important criteria to weigh.

Amenities

Location close to services such as retail establishments, dining options, and leisure activities. Buyers typically prefer to live no more than ten minutes away by car from a major supermarket.

Locational Development

Another important consideration is the presence or potential for nearby growth. In addition to negotiating a cheaper price, construction work on a home can increase its worth in the long run.

Historical Background

There’s no need to travel to another time and place to experience the same ambience and architecture of bygone days. Because it’s so difficult to imitate, a neighborhood’s established character increases in value with time.

Property due diligence

In addition to your own eyes, it is essential to have the property inspected by professionals before you commit to buying it.

- Professional building inspection wherein the inspector looks at the property’s condition, such as mould or wetness. It covers wall fissures, safety dangers, and roofing flaws.

- Pest inspection identifies mice, termites, and other pests. The pest inspector will look for current and future damage. Interior and exterior will be inspected.

- Final inspection or pre-settlement inspection which is done in the final settlement procedures to confirm any contractual requirements from the seller have been satisfied and the property is in the same condition it was when purchased.

Review the contract while buying a home

Because purchasing real estate involves going through a legal process, it is essential to work with a conveyancer or a lawyer who can assist you in managing the acquisition of the property. Reviewing the contract, negotiating the contract, finalising the contract, making preparations, and finally settling the dispute are all part of this process.

Costs associated with purchasing a home or apartment

It’s crucial to include in all the additional expenses associated with a home or apartment purchase when creating a financial plan. No one likes to be blindsided by events they weren’t anticipating. The price of a home includes more than just the down payment and mortgage.

In Summary of How to Buy an Apartment or House

Get familiar with the property’s current market worth. Make sure you’ve done your own homework and have a solid idea of how much the property might get at a public auction or through private negotiation. You might choose to hire a buyer’s agent who is familiar with the region and can advise you on reasonable price expectations and help you negotiate the best deal.

Make sure you have had the property inspected for pests and that your legal team has gone over the contract in detail. Make written offers and be open to discussing and adjusting the terms and circumstances. In order to demonstrate your seriousness as a buyer, having your financing approved in advance is essential. Finally, don’t overextend your financial means by promising more than you can provide.

Apartment Over Houses

If you are looking to buy a house in Sydney, you may be wondering which is better: an apartment or a regular house?

There are advantages and disadvantages to both. However, in a city that is known for its high property prices, it can be hard to find a place to call home. That is why purchasing an apartment is a good investment if you are just starting out as a buyer on your own.

Australia’s homeownership landscape is shifting. It used to be that only individuals, young couples, and those looking to downsize lived in apartments, but now even those with children call them home. Perhaps you like city living, where you have easy access to nightlife and dining options. Investing in real estate requires careful consideration of several variables:

- The sort of property (apartment or house) you’re looking for

- The neighbourhood

- The potential return on your investment

- It all boils down to what you really want and what you can afford.

Inhaus Living for Stunning Apartment Interior Extension/ Addition/ Renovation

For your convenience, Inhaus Living has developed a method that keeps you involved throughout the entirety of the remodelling and construction process. In our pursuit of excellence, we spare no effort. You may improve the way you interact with your home and make it uniquely yours through remodelling or building from scratch, both of which are options you have.

Through our streamlined process, Inhaus Living can assist you from the initial design stages all the way through construction and delivery of your finished project. By utilising cutting-edge design software, our team will give expression to your concepts. Through our reliable network of specialised Consultants, Engineers, Architects, Town Planners, and Certifiers, we assist you in obtaining the necessary approvals from the relevant local councils and certification authorities.

We work with reputable manufacturers and suppliers to bring you high-quality goods at reasonable prices. In the interest of your tranquility, of course. We at Inhaus Living have all the necessary permits, guarantees, and insurance coverage. We are general contractors who also focus on residential improvements like new kitchens and bathrooms. We think your house should be more than just a place to sleep; it should be a haven where you can forget about the outside world and just be yourself. We think it’s important for your house to reflect your personality and interests. Our mission is to design environments that reflect your values while providing a comfortable setting for work and leisure. With the support of Inhaus Living, your dreams can become a reality.